irs rejected return ssn already used

According to Section 6511 a of the Tax Code you typically. A case of fat fingers digits transposed a small error can result in an.

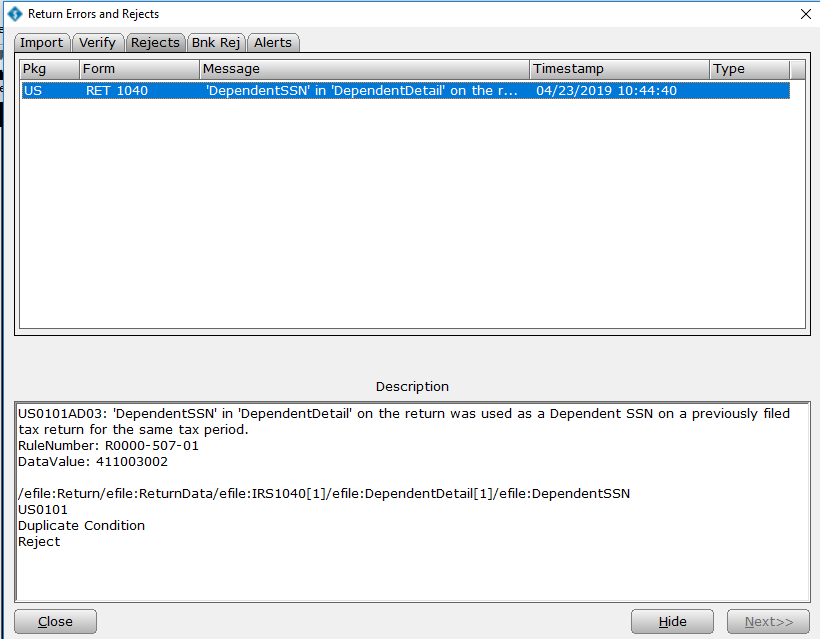

How To Find The Reason That The Irs Or State Rejected A Tax Return Simpletax Support

If my filing of my taxes is rejected because my social security number has already been usedwhat do I do.

. Potential reasons why your SSN has already been used. My 1040 was rejected with code R0000-502-001. You entered the wrong SSN on your tax return.

The Internal Revenue Service requires taxpayers to file IRS Form 1040X when the taxpayer seeks to amend an already-filed return. Before you call be aware that IRS will automatically flag your account for review. Employers engaged in a trade or business who pay compensation.

Tax Year 2019 Form 990EZ. Whether the cause of this rejection is the result of a typo on. The SSN in question also appears as the filer spouse or dependent on another tax return for this same year.

SSN has been used on a previously accepted return. Electronic copies images of Forms 990 990-EZ 990-PF or 990-T returns filed with the IRS by charities and non-profits. If someone uses your SSN to fraudulently file a tax return and claim a refund your tax return could get rejected because your SSN was already used to file a return.

We are seeing people who did not notice or ignored the. To prevent fraudulent returns the IRS only accepts a. September 23 2020 938 PM.

I called the irs and the guy didnt seem to. Use a fillable form at IRSgov. I know I have not filed previously this year.

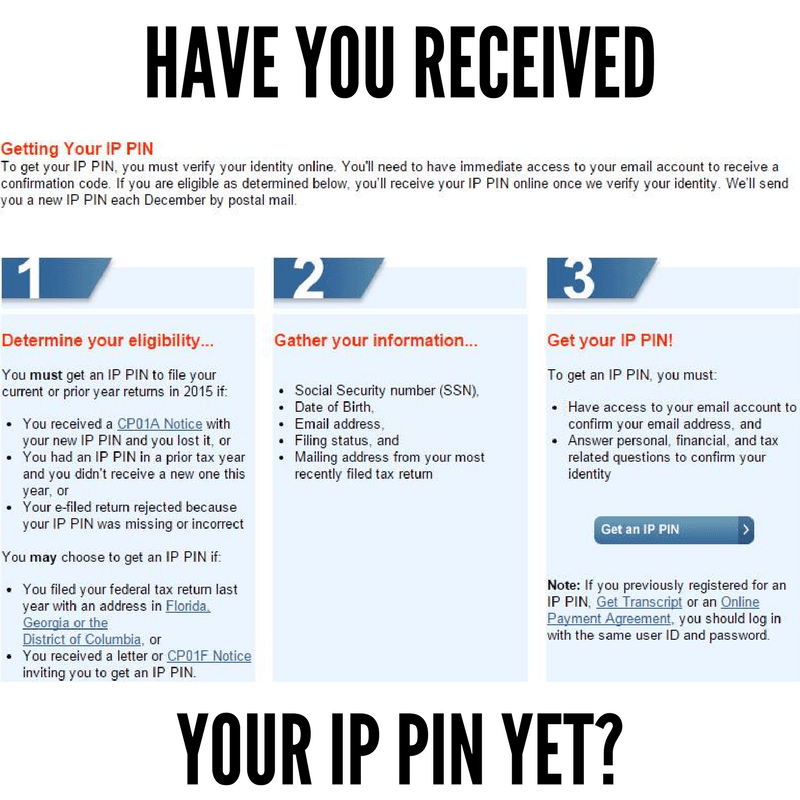

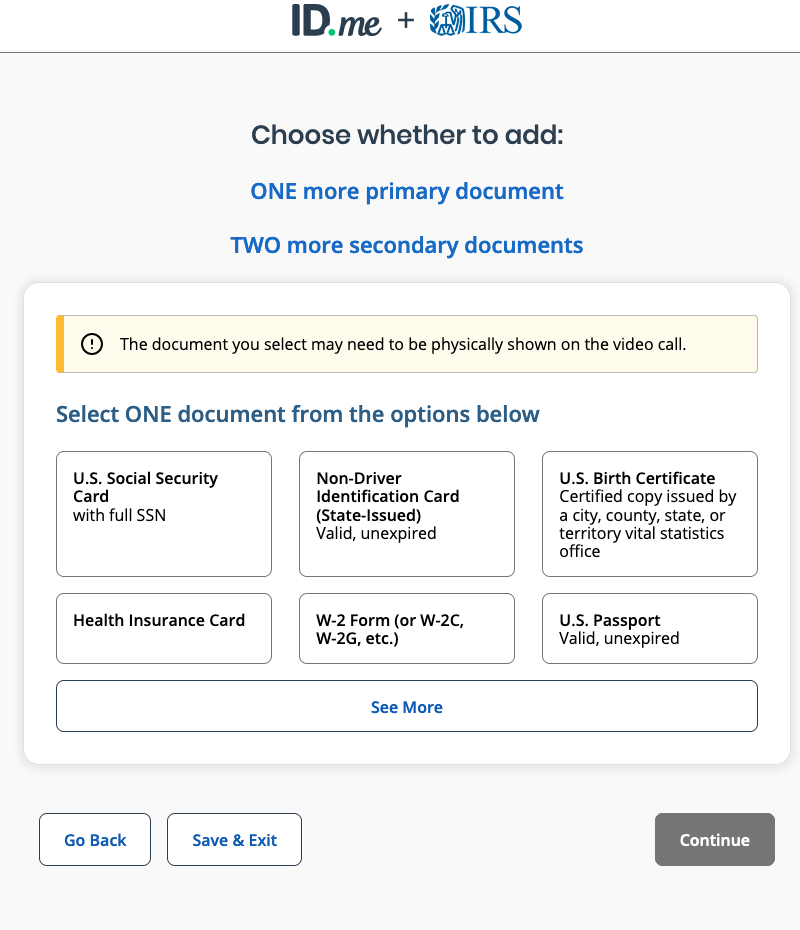

Some have suggested that heightens the chance of. Employers Quarterly Federal Tax Return. Complete IRS Form 14039 Identity Theft Affidavit if your efiled return rejects because of a duplicate filing under your SSN or you are instructed to do so.

The IRS ID Theft hot line is 1-800-908-4490. If you used the IRS non-filer site to get a stimulus check you will now get a duplicate SSN rejection. Whether the cause of this rejection is the result of a typo on another return or an attempt by another party to claim a benefit using your dependents SSN the IRS has security.

If someone uses your SSN to fraudulently file a tax return and claim a refund your tax return could get rejected because your SSN was already used to file a return.

Tax Id Theft Victim Get A Copy Of The Fraudulent Return Filed In Your Name Don T Mess With Taxes

Tax Refund Status Is Still Being Processed

Preparers Beware Ptin Fees Are Back Journal Of Accountancy

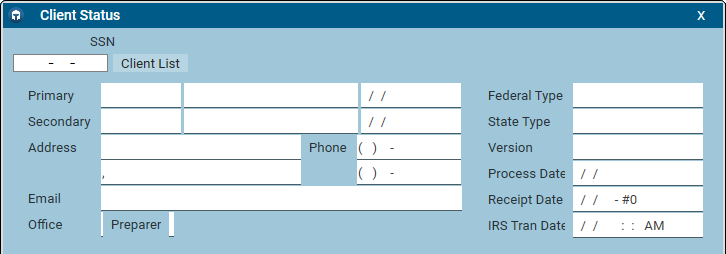

Client Status Refund Status Support

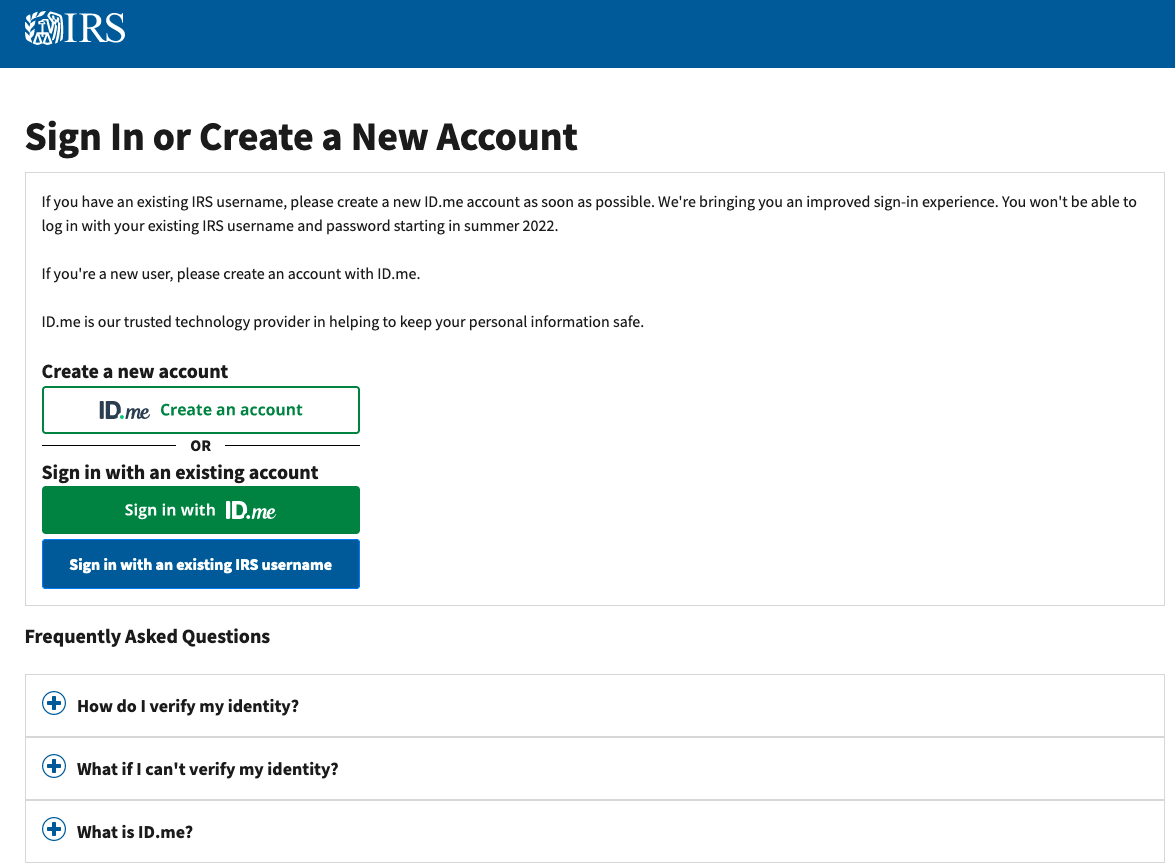

Irs Will Soon Require Selfies For Online Access Krebs On Security

10 Steps To Take If Your Tax Return Is Rejected Gobankingrates

What Got Your Tax Return Rejected And What You Can Do About It

Irs Will Soon Require Selfies For Online Access Krebs On Security

Why Is It Taking So Long To Get My Tax Refund Irs Processing Backlog Updates Aving To Invest

Non Filers Form Initially Rejected R Stimuluscheck

Someone Stole My Social Security Number To File Taxes Help The Money Coach

Your Tax Return May Get Rejected If Last Year S Filing Is Pending

1040 2021 Internal Revenue Service

Tax Tips For Avoiding E File Rejections Turbotax Tax Tips Videos

Ssn Already Used By Someone Else On A Tax Return Crossborder Planner

Don T Make These Mistakes On Your Tax Return Taxact Blog

Why Would The Irs Reject A Tax Return Tenenbaum Law P C

Fraudulent Tax Return And Identity Theft Prevention Steps

E File Return Rejected Ssn On Another Return Already Filed This Year R Tax